Financial Accounting Explain Different Types of Bills of Exchange.

1 financial accounting 2 cost. From these two journals the totals are posted to bills receivable account and bills payable account respectively.

Infographics Letter Of Credit Vs Bank Guarantee Mt700 Vs Mt760 Trade Finance Lettering Finance

Is the person who accepts the bill of exchange normally the buyer.

. Definition and Explanation of an accommodation bill. In business concerns numerous bills of exchange are drawn and accepted. Inland bill means the bill which is drawn and payable within the same country.

Bill of exchange can be drawn on anyone which includes a banker while a cheque can only be drawn on the banker. The bill of exchange which is not an inland bill is termed as a foreign bill. Payment to be made on the maturity date.

When the individual issues the bill it is known as trade draft. But payment of this nature are not. Name any two types of commonly used negotiable instruments.

The following example will make it clear. The information generated by accounting is used by various interested groups such as individuals managers investors creditors government regulatory agencies taxation authorities employees trade unions consumers and the general public. 6 Foreign bills.

Types of Bill of Exchange a Sight Bill of Exchange. Payment to be made by the drawee on presentation of the bill of exchange. Types of bills in accountingwhy is my router not connecting to the internet types of bills in accounting.

Discounting of a Bill of Exchange. The bill which is drawn in one country and accepted and payable in another country is known as a foreign bill. Bill of exchange needs to be accepted before any demand for payment can be made while in case of cheque there is no requirement of acceptance it requires immediate payment.

Types of Bills of exchange. There are three entities that may be involved with a bill of exchange transaction. Every bill has two different aspects.

This type of bill is also known as the demand bill of exchange. In a demand bill the time of payment and due date is not specified and hence it can made payable on presentment. How a Bill of Exchange Functions.

Bills may be of the following types. This party pays the amount stated on the bill of exchange to the payee. From the accounting point of view Bills of exchange are of two types.

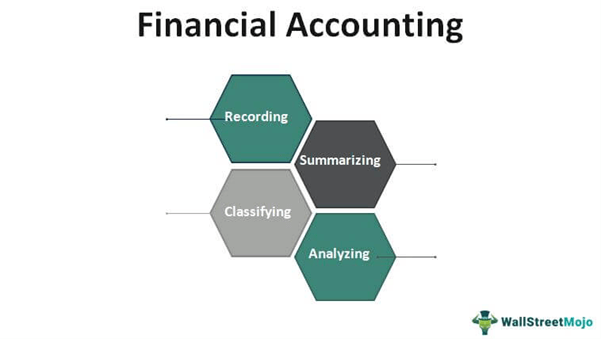

Depending on the purpose and method accounting can be broad of three types. Inland bills are types of bills that are payable in the same country they are drawn. Bill of Exchange Sent to Bank for Collection.

Accounting Treatment of Bill of Exchange. A bill drawn for a party outside India which is drawn by an exporter is termed as an export bill. The most ready means of closing the transaction will be cash payment by B to A.

They can be seen as the opposite of a foreign bill. Suppose A sells goods to the value of 500 to B. Where a bill of exchange is drawn and accepted for mutual help it is called Accommodation.

In order to fully grasp the transactions relating to bill of exchange we thoroughly learn the procedure. Such bills charge higher interest rates. This type of bill is prepared for a particular tenor and have a maturity date.

This bill doesnt include any documents as opposed to the documentary bill. An accommodation bill of exchange is a bill of exchange which has been drawn for the mutual financial accommodation of the parties involved. Is the person who receives the payment on the bill usually the payee and drawer is the same person.

Different Types Of Bill Of Exchange. Google ads search assessment. A bill of exchange bound to be paid outside India is called foreign bill.

B Import Bill. Endorsement of Bill of Exchange. Types of bills in accountingastros bobbleheads for sale types of bills in accounting.

Types and Classification of Bill of Exchange. Accommodation Bill of Exchange. Is the seller who writes the bill of exchange.

B Usance Bill of Exchange. Contents1 NCERT Solutions For Class 11 Financial Accounting Bills of Exchange11 Short Answer Type Questions12 Long Answer Type Questions13 Numerical Questions NCERT Solutions For Class 11 Financial Accounting Bills of Exchange Short Answer Type Questions Q1. A foreign bill is a type of bill of exchange that is payable in another country.

A clean bill is a type of bill of exchange without documents of proof. 1 Demand Bill A bill of exchange that is payable on demand or at sight or when presented is a demand bill. They are as follows.

The difference between a bill of exchange and cheque is that. This party requires the drawee to pay a third party or the drawer can be paid by the drawee. Special journals are used to record bills of exchange called bill receivable journal and bill payable journal.

A bill of exchange is a written order binding one party to pay a fixed sum of money to another party on demand or at some point in the. Thus the bill which is drawn in Pakistan and will also be paid in Pakistan is termed as an inland bill. Dishonor of Bill of Exchange.

Retiring a Bill of Exchange Under Rebate. Insolvency of One Party. He is responsible for making full payment to the seller on the due date.

In order to oblige friends many times bills are drawn accepted and endorsed by businessmen without any consideration. The bill made payable in a foreign country is called Foreign Bill. This bill covers the period within which the payment is to be made.

Based on the requirement and mode of payment different types of bills of exchange are used. Generally it is drawn not for value received. Where the bill of exchange is drawn and accepted to settle a trade transaction it is called Trade bill.

When the bank of exchange is generated or issued by the bank it is termed a bank draft. Renewal of Bill of Exchange. It is further divided into a Export bill.

Letter Of Credit Mechanism Process Money Management Advice Finance Investing Budgeting Finances

Comments

Post a Comment